Addition Wealth • 2022–2025

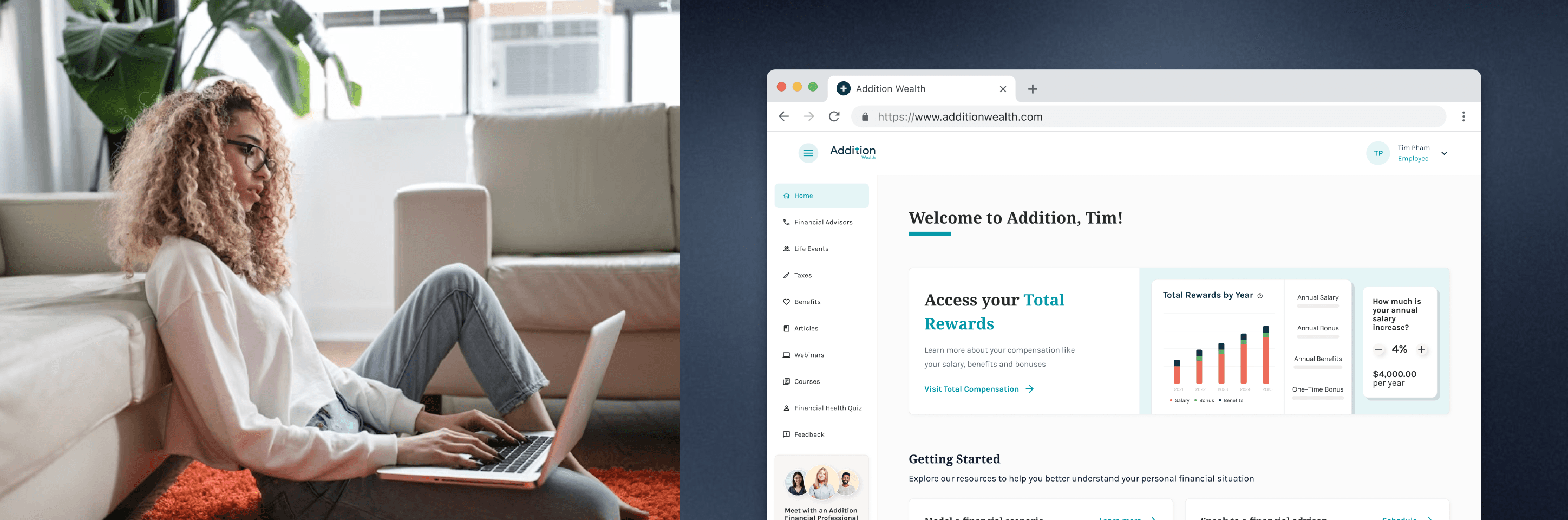

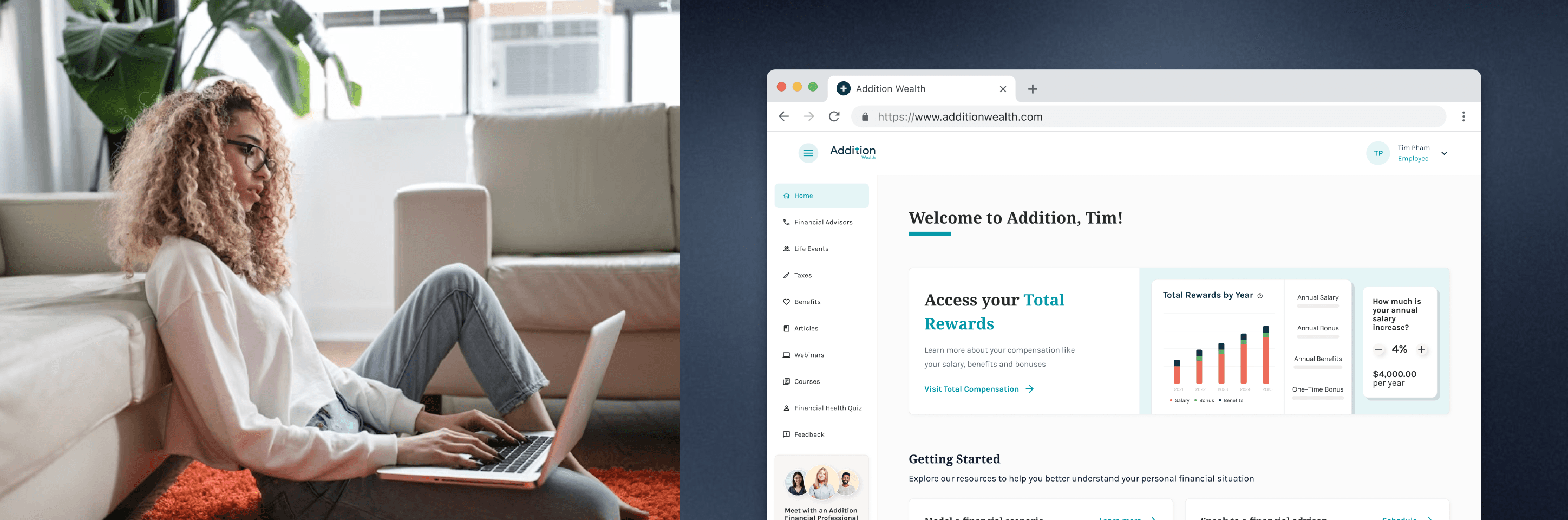

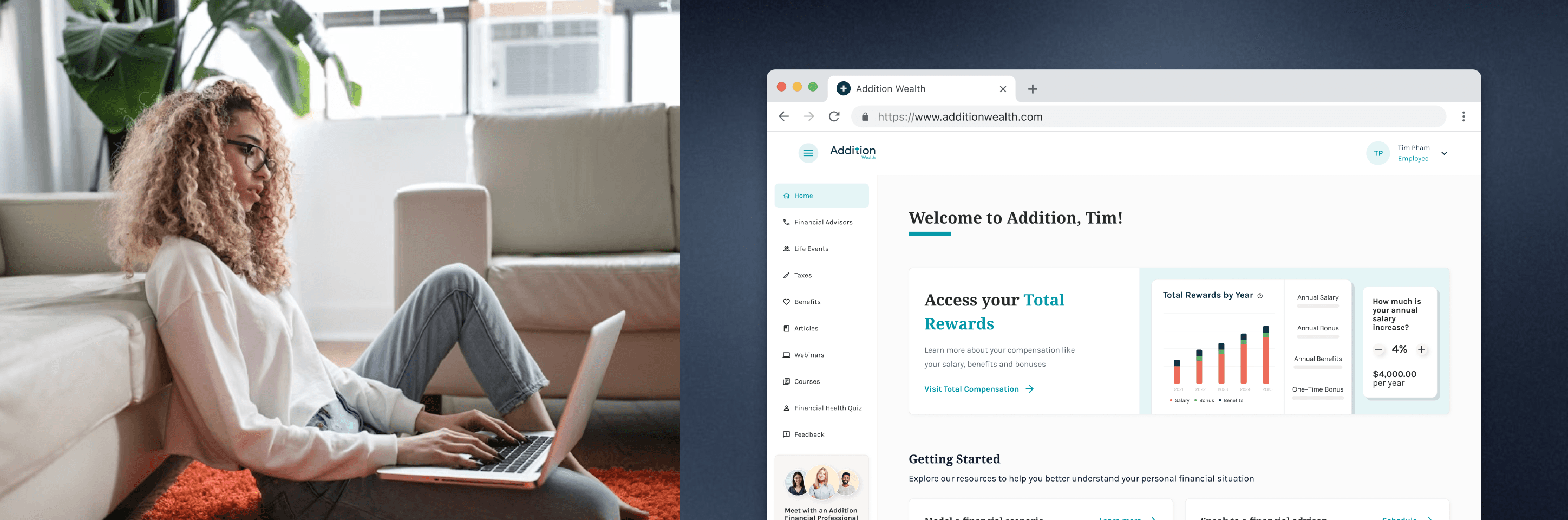

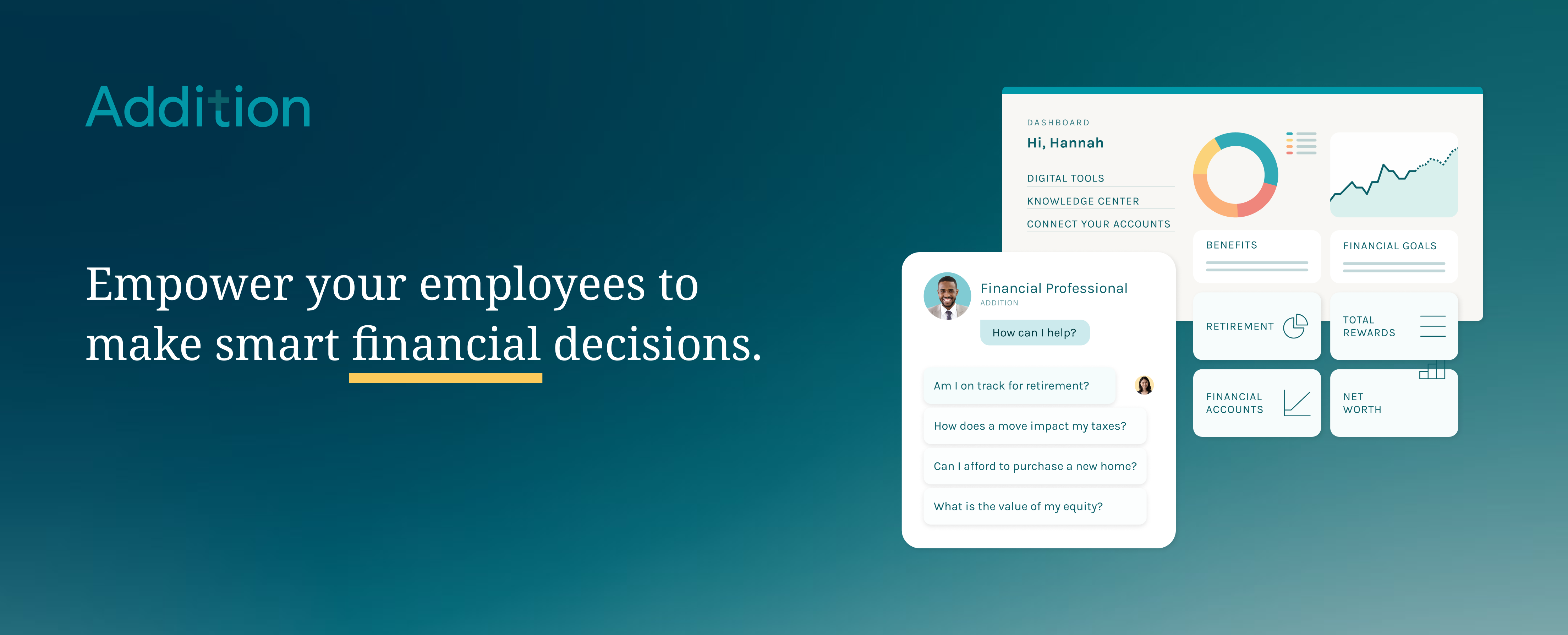

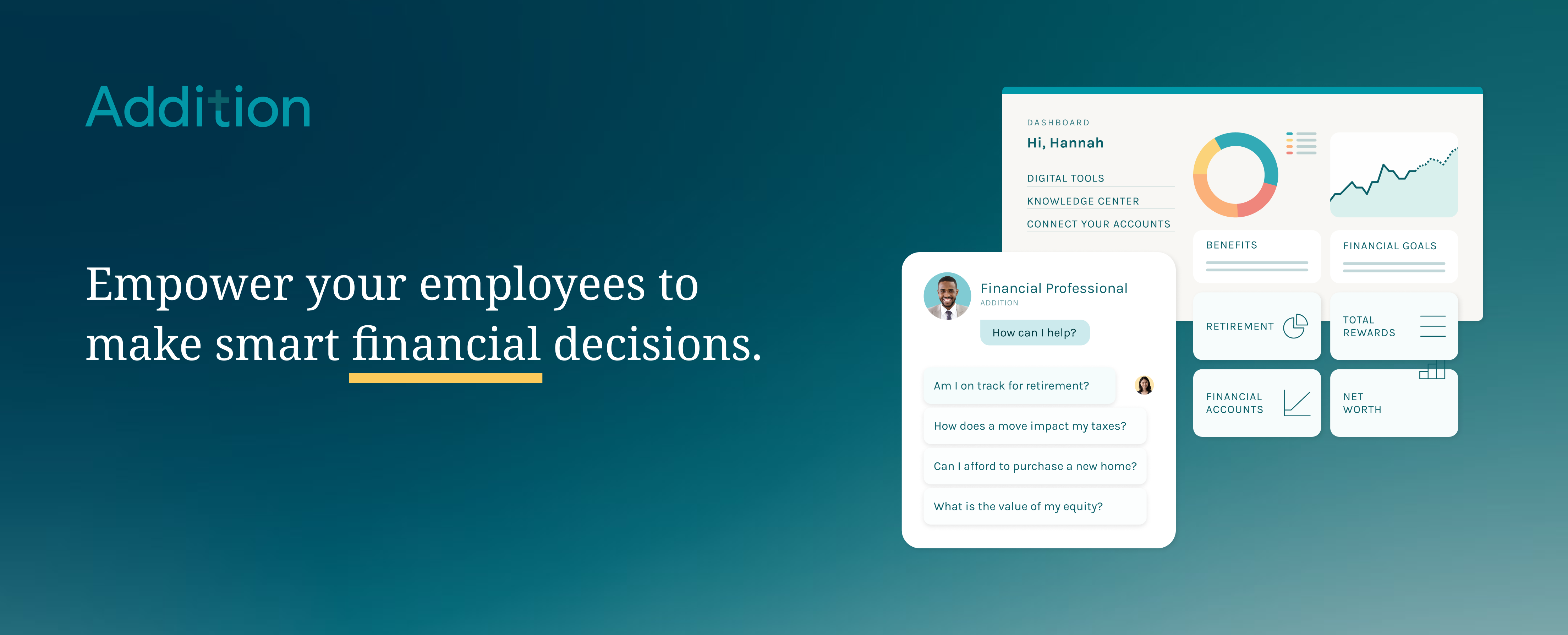

Building a financial wellness platform to help employees make smarter, more informed decisions

Building a financial wellness platform to help employees make smarter, more informed decisions

Building a financial wellness platform to help employees make smarter, more informed decisions

Problem

Millions of employees face challenges with financial literacy and decision-making, often resulting in poor financial outcomes. According to the PwC Employee Financial Wellness Survey, over 72% of employees reported feeling stressed about money, yet most companies fall short in providing the support they need. This financial stress directly impacts workplace productivity, leading to preventable losses for employers.

Millions of employees face challenges with financial literacy and decision-making, often resulting in poor financial outcomes. According to the PwC Employee Financial Wellness Survey, over 72% of employees reported feeling stressed about money, yet most companies fall short in providing the support they need. This financial stress directly impacts workplace productivity, leading to preventable losses for employers.

Millions of employees face challenges with financial literacy and decision-making, often resulting in poor financial outcomes. According to the PwC Employee Financial Wellness Survey, over 72% of employees reported feeling stressed about money, yet most companies fall short in providing the support they need. This financial stress directly impacts workplace productivity, leading to preventable losses for employers.

Role

As the Founding Product Designer, I was the sole designer at the company and responsible for helping Addition Wealth build their financial wellness platform, supporting design through Seed to Series B ARR ($5M+).

Wearing many hats, I drove UX/UI, customer research, product strategy, branding, and front-end development. During my time here, I worked directly with leadership, engineering, product, and GTM to build our pproduct used by thousands of employees nationwide.

As the Founding Product Designer, I was the sole designer at the company and responsible for helping Addition Wealth build their financial wellness platform, supporting design through Seed to Series B ARR ($5M+).

Wearing many hats, I drove UX/UI, customer research, product strategy, branding, and front-end development. During my time here, I worked directly with leadership, engineering, product, and GTM to build our pproduct used by thousands of employees nationwide.

As the Founding Product Designer, I was the sole designer at the company and responsible for helping Addition Wealth build their financial wellness platform, supporting design through Seed to Series B ARR ($5M+).

Wearing many hats, I drove UX/UI, customer research, product strategy, branding, and front-end development. During my time here, I worked directly with leadership, engineering, product, and GTM to build our pproduct used by thousands of employees nationwide.

Outcomes

12+

12+

major feature launches

major feature launches

2M+

2M+

unique users onboarded

unique users onboarded

90%

90%

average monthly CSAT score

average monthly CSAT score

$5M+

$5M+

annual recurring revenue

annual recurring revenue

Establishing Addition's first design system

Establishing Addition's first design system

Establishing Addition's first design system

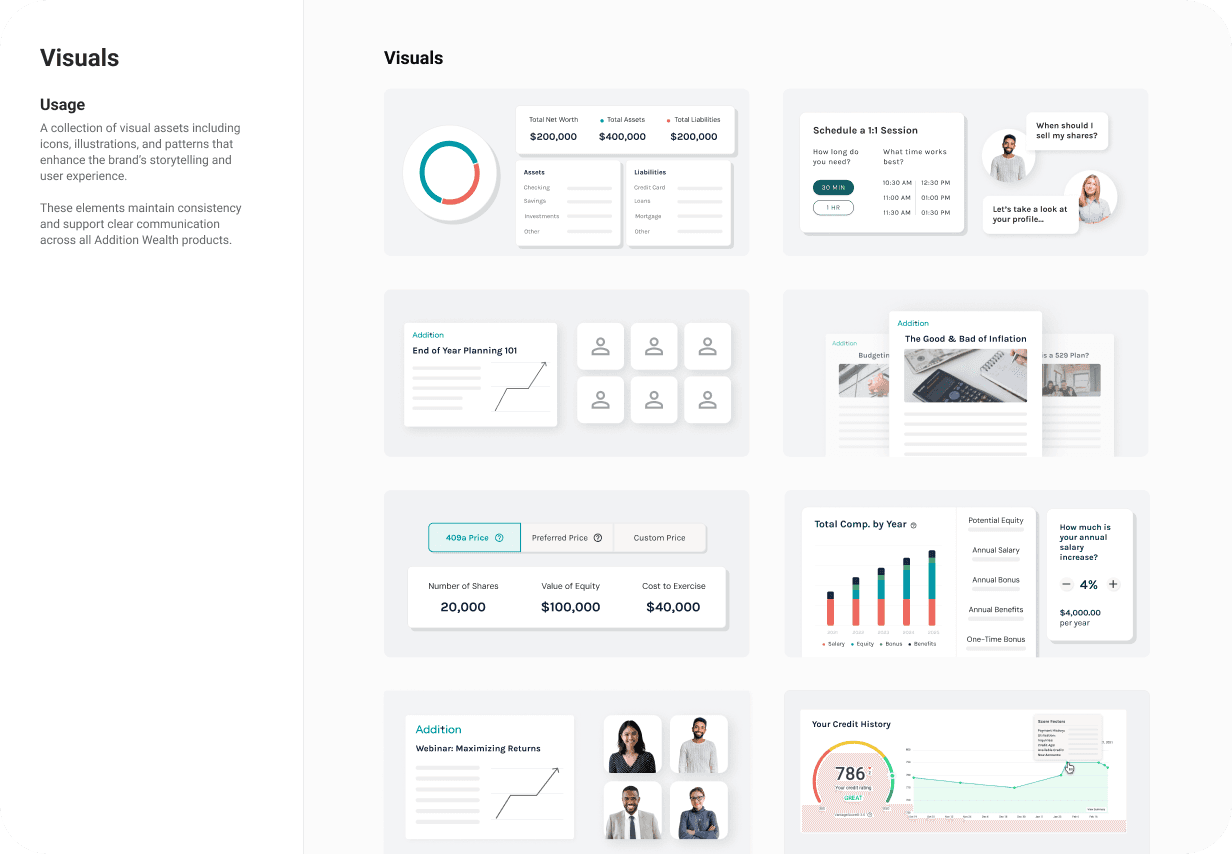

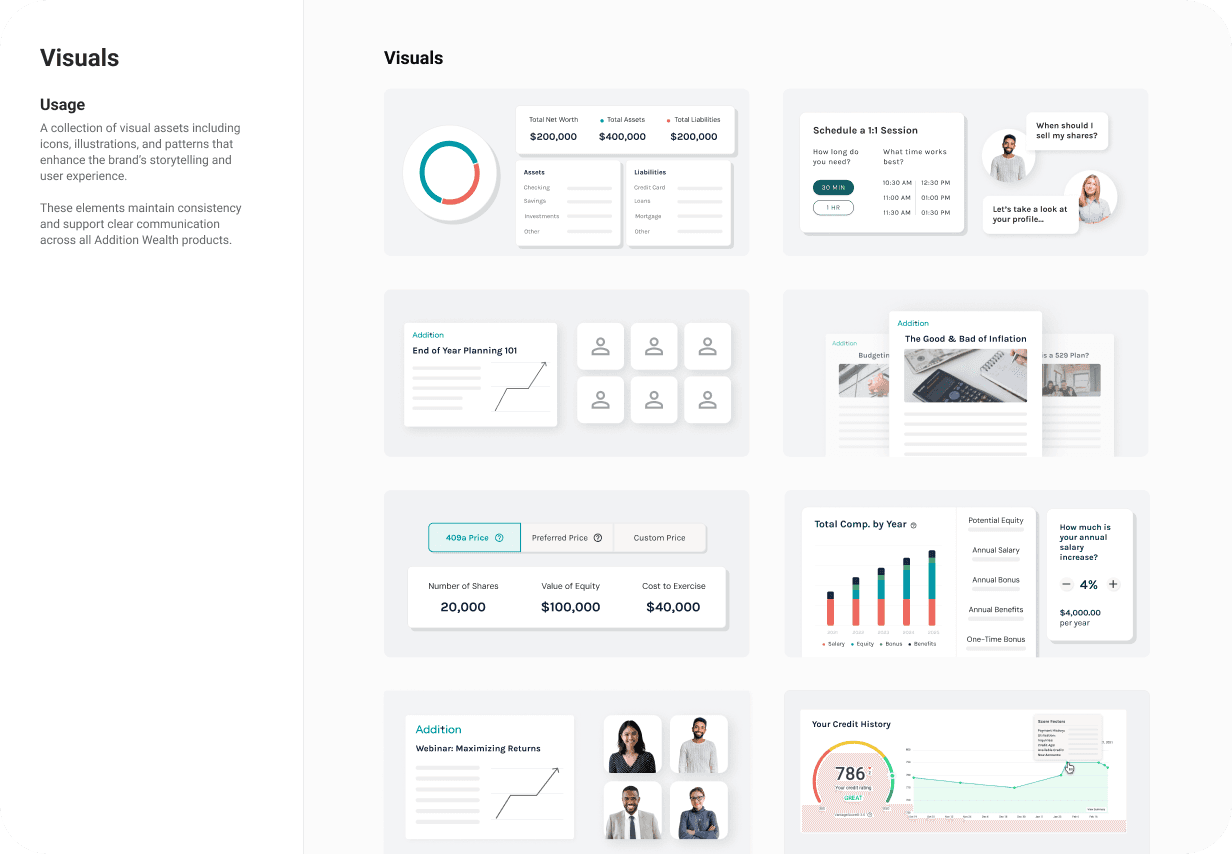

When I joined Addition, the product lacked a cohesive visual language and user experience, which made it feel forgettable and untrustworthy to users. In the context of a financial product, establishing trust is critical, users need to feel confident when sharing sensitive financial information, which directly impacts adoption and retention.

I took the initiative to partner with engineering to build our first design system in Figma; defining front-end component guidelines and core design patterns. I also led maintenance and evolution of the design system, scaling it to support multiple product ecosystems across the business.

When I joined Addition Wealth, the product lacked a cohesive visual language and user experience, which made it feel forgettable and untrustworthy to users. In the context of a financial product, establishing trust is critical.

I designed and build the first design system (Compound Design System) in Figma; defining front-end component guidelines, maintenance processes and core design patterns.

I also led the enterprise-scaling of Compound, scaling it to support multiple product ecosystems across our client portfolio.

When I joined the team, the app lacked a modern, cohesive visual language, resulting in a poor user experience.

To address this, I took initiative to build and scale our design system in Figma (including primitives, components, and usage guidelines).

Balancing craft with data to build end-to-end products

Balancing craft with data to build end-to-end products

Balancing craft with data to build end-to-end products

My design process involves adapting the Double Diamond framework, moving from discovery to definition, then into ideation and delivery. However in practice, this process is far from linear and required constant adaptation. As a solo designer, I scoped and led projects end-to-end, often going beyond my role responsibilities, drafting PRDs and conducting QA testing to ensure that we shipped features on time. Not only did we exceed client expectations, we constantly raised the bar for our industry's design.

My design process involves adapting the Double Diamond framework, moving from discovery to definition, then into ideation and delivery. However in practice, this process is far from linear and required constant adaptation. As a solo designer, I scoped and led projects end-to-end, often going beyond my role responsibilities, drafting PRDs and conducting QA testing to ensure that we shipped features on time. Not only did we exceed client expectations, we constantly raised the bar for our industry's design.

My design process involves adapting the Double Diamond framework, moving from discovery to definition, then into ideation and delivery. However in practice, this process is far from linear and required constant adaptation. As a solo designer, I scoped and led projects end-to-end, often going beyond my role responsibilities, drafting PRDs and conducting QA testing to ensure that we shipped features on time. Not only did we exceed client expectations, we constantly raised the bar for our industry's design.

What were our user pain points?

1.

1.

1.

Users want to understand their individual, unique financial situation.

Users want to understand their individual, unique financial situation.

Users want to understand their individual, unique financial situation.

2.

2.

2.

Users want to receive clear, personalized guidance.

Users want to receive clear, personalized guidance.

Users want to receive clear, personalized guidance.

3.

3.

3.

Users want to measure their progress over time.

Users want to measure their progress over time.

Users want to measure their progress over time.

What were our business challenges?

1.

1.

1.

Low engagement limits user adoption.

Low engagement limits user adoption.

Low engagement limits user adoption.

2.

2.

2.

Lack of personalization reduces relevance and trust in the product.

Lack of personalization reduces relevance and trust in the product.

Lack of personalization reduces relevance and trust in the product.

3.

3.

3.

Inconsistent user experience weakens product cohesion and user confidence.

Inconsistent user experience weakens product cohesion and user confidence.

Inconsistent user experience weakens product cohesion and user confidence.

Building tools to support employees through their financial journey

Building tools to support employees through their financial journey

Building tools to support employees through their financial journey

Equity calculators

Equity calculators

Equity calculators

Equity (i.e. stock) is a crucial part of an employee's compensation package, yet many struggle to understand its true value. Surprisingly, it's the most overlooked aspect during hiring negotiations, leading to millions of dollars in lost wages.

To close this knowledge gap, I designed interactive calculators that could determine potential equity value based on various scenarios like share price and company performance. These tools became important resources for our financial advisors and eager users to make informed, timely decisions.

Equity (i.e. stock) is a crucial part of an employee's compensation package, yet many struggle to understand its true value. Surprisingly, it's the most overlooked aspect during hiring negotiations, leading to millions of dollars in lost wages.

To close this knowledge gap, I designed interactive calculators that could determine potential equity value based on various scenarios like share price and company performance. These tools became important resources for our financial advisors and eager users to make informed, timely decisions.

Equity (i.e. stock) is a crucial part of an employee's compensation package, yet many struggle to understand its true value. Surprisingly, it's the most overlooked aspect during hiring negotiations, leading to millions of dollars in lost wages.

To close this knowledge gap, I designed interactive calculators that could determine potential equity value based on various scenarios like share price and company performance. These tools became important resources for our financial advisors and eager users to make informed, timely decisions.

Financial accounts

Financial accounts

Financial accounts

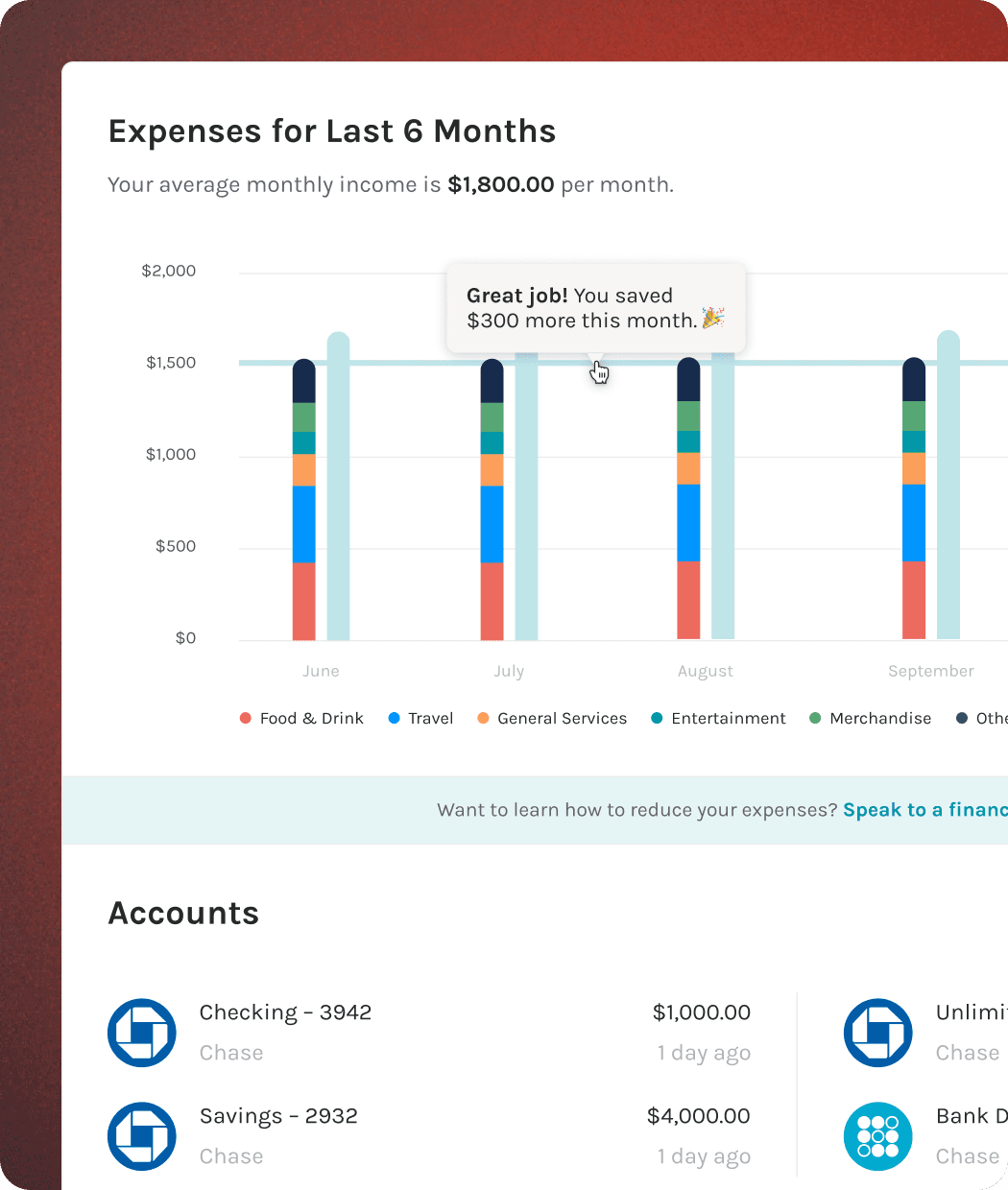

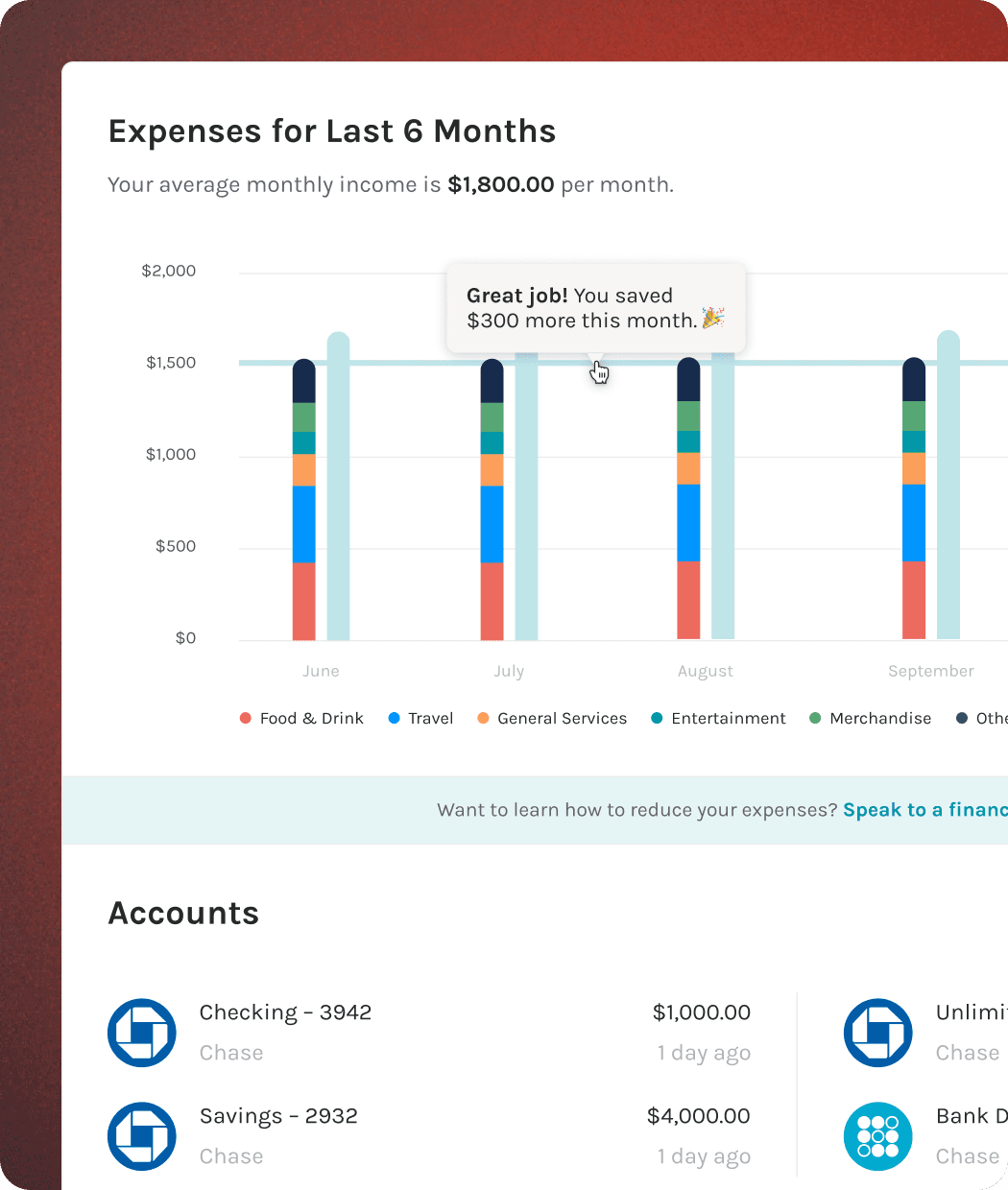

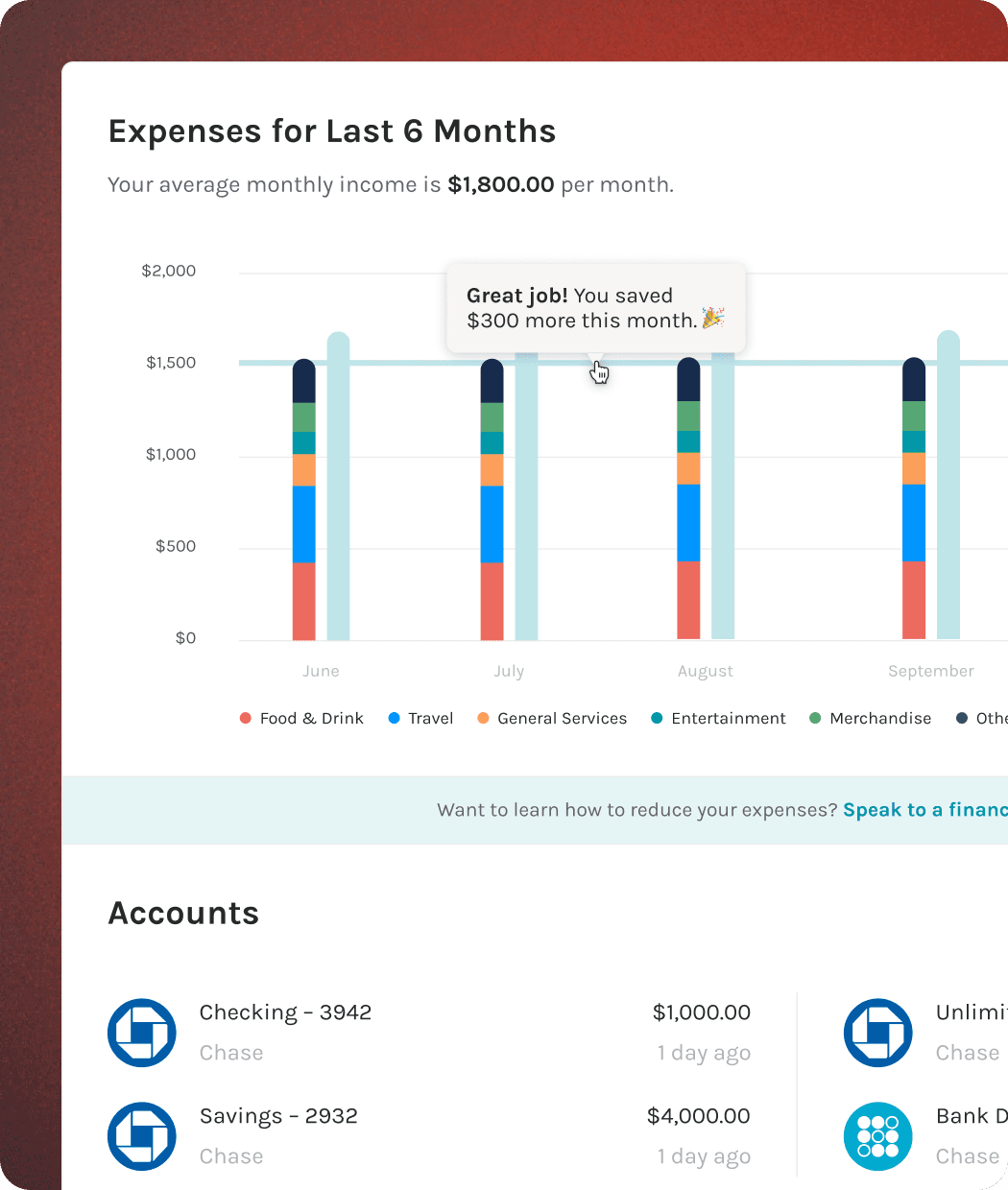

Surveys revealed that 80% of employees want to make progress toward their financial goals but feel too overwhelmed to take action without a clear understanding finances.

To address this problem, I designed a financial account management system that gave users real-time visibility into their cash flow. My work included creating complex user flows that unified banking, investment, and retirement accounts into a single, streamlined experience.

Surveys revealed that 80% of employees want to make progress toward their financial goals but feel too overwhelmed to take action without a clear understanding finances.

To address this problem, I designed a financial account management system that gave users real-time visibility into their cash flow. My work included creating complex user flows that unified banking, investment, and retirement accounts into a single, streamlined experience.

Surveys revealed that 80% of employees want to make progress toward their financial goals but feel too overwhelmed to take action without a clear understanding finances.

To address this problem, I designed a financial account management system that gave users real-time visibility into their cash flow. My work included creating complex user flows that unified banking, investment, and retirement accounts into a single, streamlined experience.

Life events

Life events

Life events

Through Zoom interviews, I chatted with users about their current experience using Addition and found that behaviorally, most people have trouble focusing on more than one financial challenge. I hypothesized that a targeted experience, where users could utilize tools and resources to answer specific questions like “How much do I need to save before having my first child?” would be the most effective approach.

To address this insight, I designed resource centers that provided guidance on a specific financial question aka 'life events'. The main goal was to help users through major financial milestones, like switching jobs or preparing for a child. This feature became one of our highest-traffic areas, helping users to contextualize their finances, receive personalized insights, and take clear steps toward their goals.

Through Zoom interviews, I chatted with users about their current experience using Addition and found that behaviorally, most people have trouble focusing on more than one financial challenge. I hypothesized that a targeted experience, where users could utilize tools and resources to answer specific questions like “How much do I need to save before having my first child?” would be the most effective approach.

To address this insight, I designed resource centers that provided guidance on a specific financial question aka 'life events'. The main goal was to help users through major financial milestones, like switching jobs or preparing for a child. This feature became one of our highest-traffic areas, helping users to contextualize their finances, receive personalized insights, and take clear steps toward their goals.

Through Zoom interviews, I chatted with users about their current experience using Addition and found that behaviorally, most people have trouble focusing on more than one financial challenge. I hypothesized that a targeted experience, where users could utilize tools and resources to answer specific questions like “How much do I need to save before having my first child?” would be the most effective approach.

To address this insight, I designed resource centers that provided guidance on a specific financial question aka 'life events'. The main goal was to help users through major financial milestones, like switching jobs or preparing for a child. This feature became one of our highest-traffic areas, helping users to contextualize their finances, receive personalized insights, and take clear steps toward their goals.

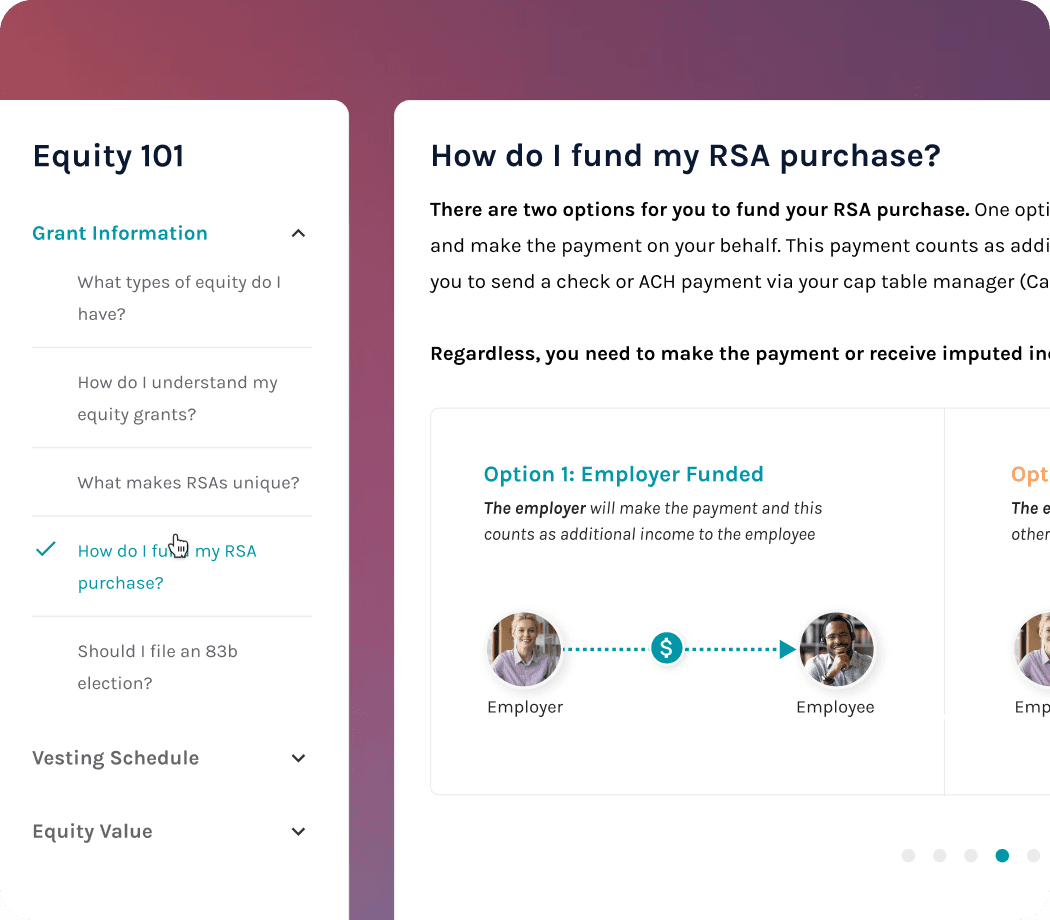

Learning courses

Learning courses

Learning courses

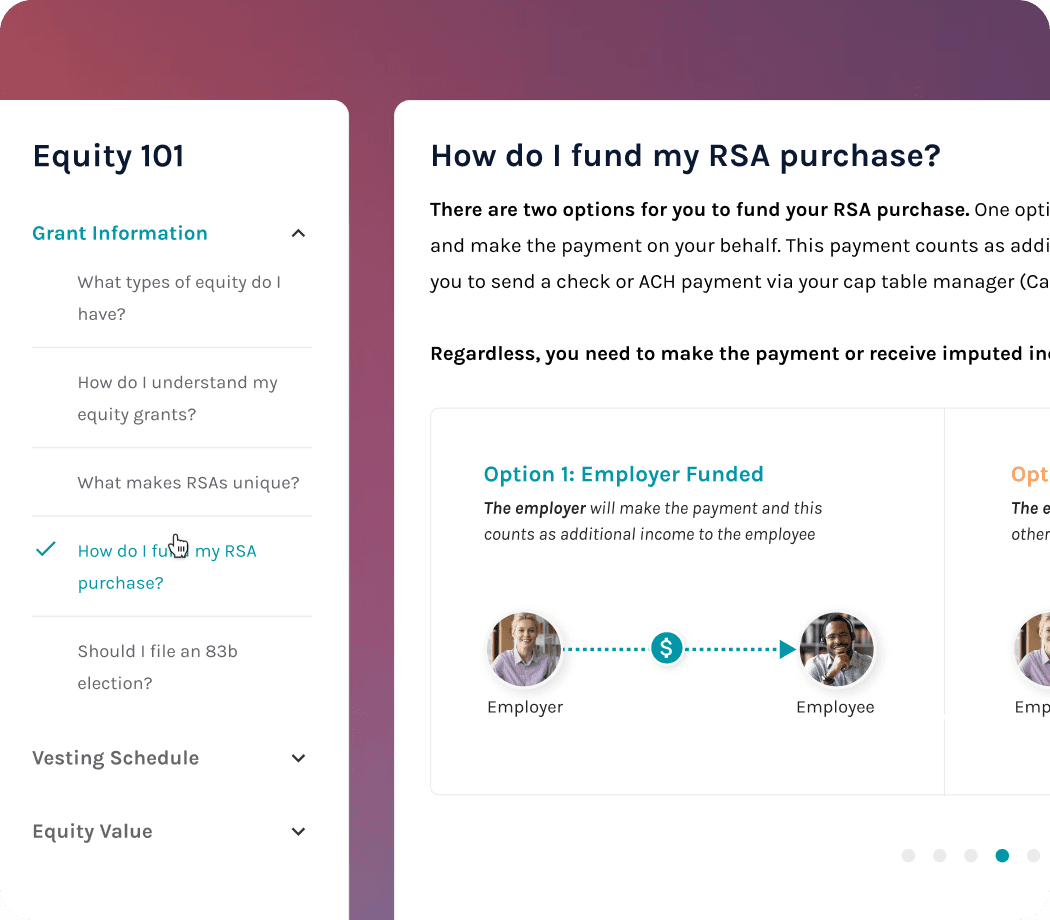

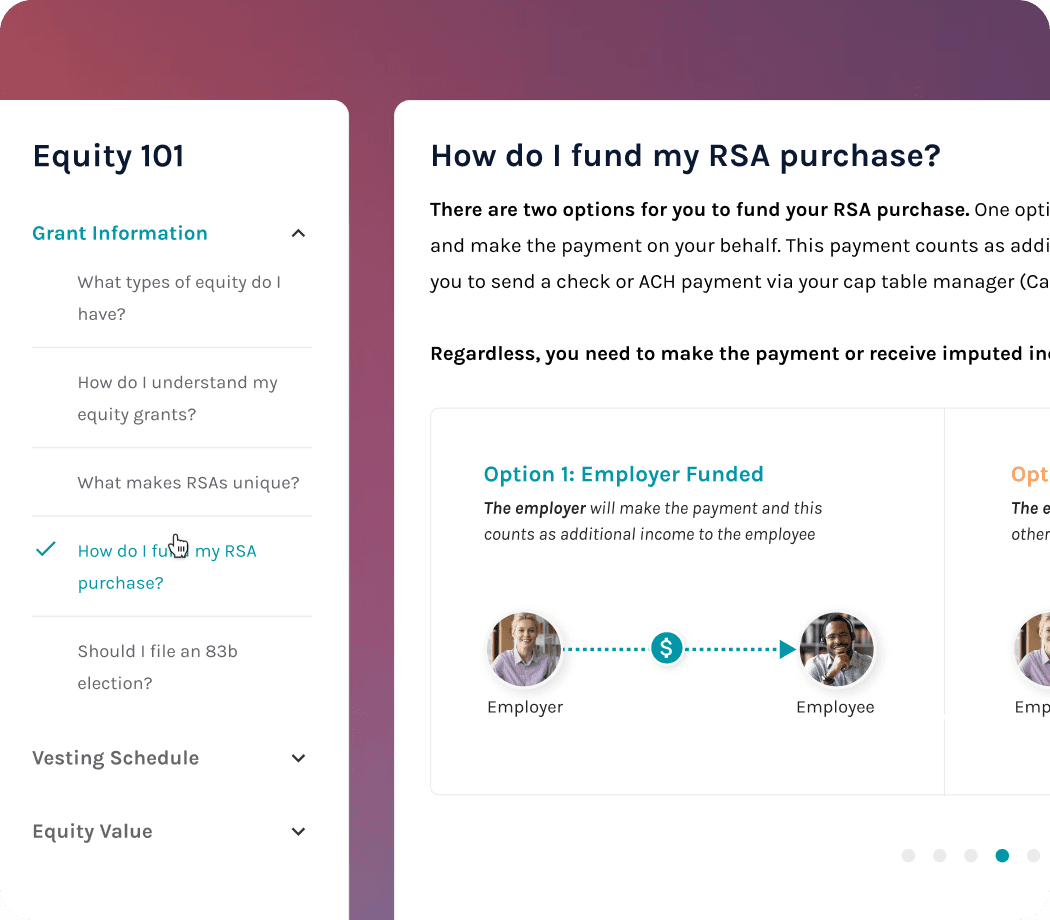

Historically, we only offered articles and online webinars which limited reach and slowed engagement. Users were having a hard time getting into generic, boring content. We wanted to provide another vehicle for learning, so I designed interactive courses, which provided dynamic content (i.e. income, taxes, equity grants) based on the user's personal finances.

I led content design for this effort, working closely with our financial advisors, covering 15+ key financial topics. This work included drafting copy, crafting infographics, and performing QA on the app to ensure each piece was both informative and easy-to-understand.

Historically, we only offered articles and online webinars which limited reach and slowed engagement. Users were having a hard time getting into generic, boring content. We wanted to provide another vehicle for learning, so I designed interactive courses, which provided dynamic content (i.e. income, taxes, equity grants) based on the user's personal finances.

I led content design for this effort, working closely with our financial advisors, covering 15+ key financial topics. This work included drafting copy, crafting infographics, and performing QA on the app to ensure each piece was both informative and easy-to-understand.

Historically, we only offered articles and online webinars which limited reach and slowed engagement. Users were having a hard time getting into generic, boring content. We wanted to provide another vehicle for learning, so I designed interactive courses, which provided dynamic content (i.e. income, taxes, equity grants) based on the user's personal finances.

I led content design for this effort, working closely with our financial advisors, covering 15+ key financial topics. This work included drafting copy, crafting infographics, and performing QA on the app to ensure each piece was both informative and easy-to-understand.

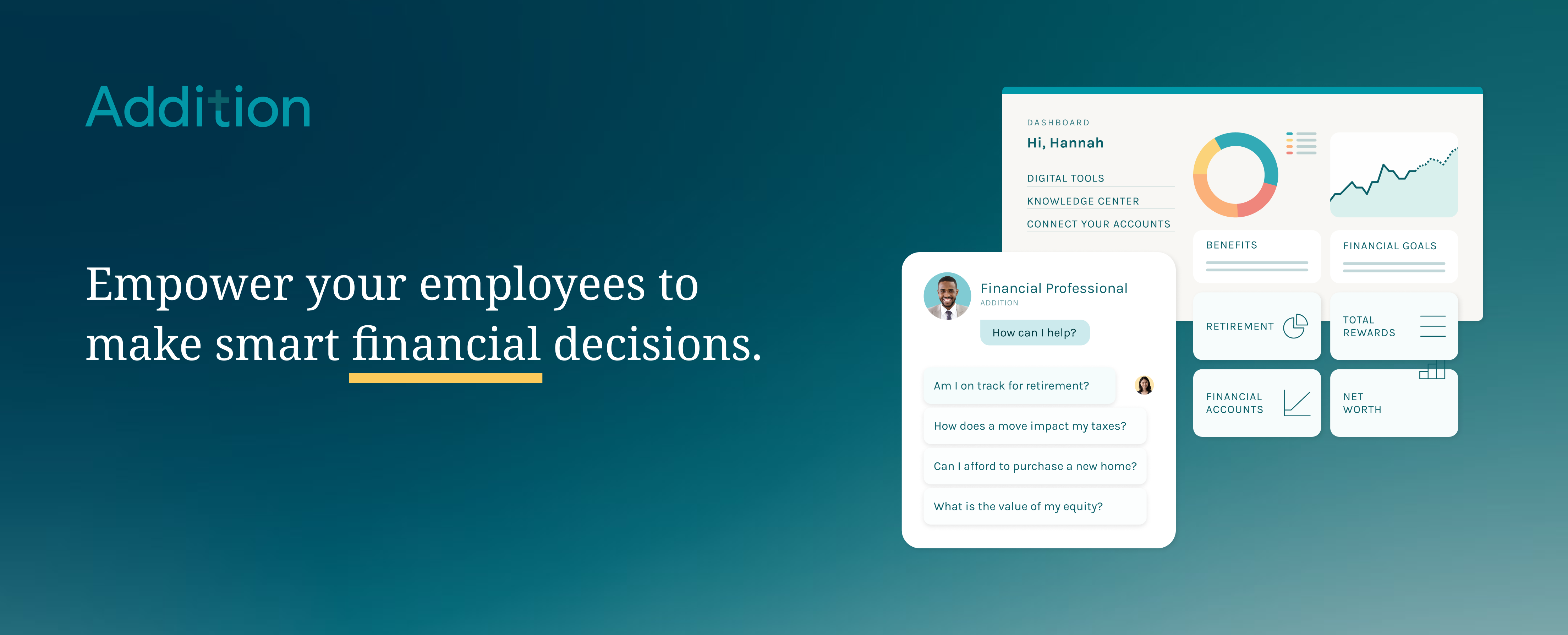

Aligning enterprise clients with our product vision

Aligning enterprise clients with our product vision

Aligning enterprise clients with our product vision

Aside from building the core platform, I directly collaborated with enterprises to launch financial advisory platforms: Balance Wellbeing, Edward Jones at Work, and AARP . I helped design and launch products through these partnerships that extended our reach to millions. This expansion became new distribution channels for Addition Wealth, and painstakingly requiring alignment across multiple departments, security protocols, and compliance standards.

As Addition Wealth evolved from serving tech startups to working with enterprises, the design challenges became increasingly complex. Each enterprise had its own legal, brand, and technical requirements. I supported the effort to scale our existing technology and led design for company-specific UX/UI, creating processes which reduced engineering work along the way.

Aside from building the core platform, I directly collaborated with enterprises to launch financial advisory platforms: Balance Wellbeing, Edward Jones at Work, and AARP . I helped design and launch products through these partnerships that extended our reach to millions. This expansion became new distribution channels for Addition Wealth, and painstakingly requiring alignment across multiple departments, security protocols, and compliance standards.

As Addition Wealth evolved from serving tech startups to working with enterprises, the design challenges became increasingly complex. Each enterprise had its own legal, brand, and technical requirements. I supported the effort to scale our existing technology and led design for company-specific UX/UI, creating processes which reduced engineering work along the way.

Aside from building the core platform, I directly collaborated with enterprises to launch financial advisory platforms: Balance Wellbeing, Edward Jones at Work, and AARP . I helped design and launch products through these partnerships that extended our reach to millions. This expansion became new distribution channels for Addition Wealth, and painstakingly requiring alignment across multiple departments, security protocols, and compliance standards.

As Addition Wealth evolved from serving tech startups to working with enterprises, the design challenges became increasingly complex. Each enterprise had its own legal, brand, and technical requirements. I supported the effort to scale our existing technology and led design for company-specific UX/UI, creating processes which reduced engineering work along the way.

Met a lot of awesome people along the way. Here are some shoutouts from my team .ᐟ.ᐟ.ᐟ.ᐟ

Met a lot of awesome people along the way. Here are some shoutouts from my team .ᐟ.ᐟ.ᐟ.ᐟ

Met a lot of awesome people along the way. Here are some shoutouts from my team .ᐟ.ᐟ.ᐟ.ᐟ

“Tim has a great eye for design, and all his work leads to a product that is pleasant to use. He also understands the tradeoff between usability and aesthetics, so when engineers push back on certain design choices because it could cause inadvertent issues, he will go for whatever is best for the user.”

“Tim has a great eye for design, and all his work leads to a product that is pleasant to use. He also understands the tradeoff between usability and aesthetics, so when engineers push back on certain design choices because it could cause inadvertent issues, he will go for whatever is best for the user.”

“Tim has a great eye for design, and all his work leads to a product that is pleasant to use. He also understands the tradeoff between usability and aesthetics, so when engineers push back on certain design choices because it could cause inadvertent issues, he will go for whatever is best for the user.”

Staff Software Engineer

“Tim is a talented designer and is very responsive. Whenever I have a question or am looking for a resource he is always helpful. He has helped transform the app and it looks beautiful! It’s a great interface and our clients and anyone who sees the platform can appreciate all of the work he has done!”

“Tim is a talented designer and is very responsive. Whenever I have a question or am looking for a resource he is always helpful. He has helped transform the app and it looks beautiful! It’s a great interface and our clients and anyone who sees the platform can appreciate all of the work he has done!”

“Tim is a talented designer and is very responsive. Whenever I have a question or am looking for a resource he is always helpful. He has helped transform the app and it looks beautiful! It’s a great interface and our clients and anyone who sees the platform can appreciate all of the work he has done!”